There is no place on earth as comfortable as living in your own home. This is why owning a house by themselves has become a crucial milestone in the life of most people.

However, building your own house or buying your place can be costly. That is why it has always remained a dream and not a reality for most individuals. What if you can get some help from the government? Wouldn’t you be able to make your dream a reality?

Then this article is for you. This article will list the government schemes and grants that will help you to build your house.

Nationwide government schemes and grants

These are the government programs that stay consistent throughout all states of Australia.

1. First Home Guarantee

The First Home Guarantee was previously known as First Home Loan Deposit Scheme. This program allows people looking to buy a new or an existing house for the first time with a very small deposit ranging from 5% to 20% of the property’s value. Therefore borrowers don’t have to pay tens of thousands of dollars as LMI (Lenders Mortgage Insurance).

What happens here is that the government acts as the mortgage insurer for selected first-home buyers. Suppose a borrower deposits a minimum amount of 5% of the property’s value. In that case, the government will provide a guarantee for the loan not exceeding 15% of the property’s value.

The guarantee provided by the government is not a cash payment or deposit for the loan.

There are certain limitations to the price caps on eligible properties depending on the area in which the property is located. This scheme is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian government. The NHIFC provides 35000 places for this scheme in each financial year starting from 1st July 2022.

If you want to qualify for the First Home Guarantee, you should be:

- A first-time home buyer (I have not owned properties in Australia before).

- Have citizenship in Australia (Permanent residents are not considered).

- Should have earned up to $125,000 for individuals or $200,000 for couples, as shown on the Notice of Assessment (issued by the Australian Taxation Office).

- Should be 18 years of age or more.

- Should be buying the property intending to own and occupy the property.

You can check your eligibility criteria from here more easily.

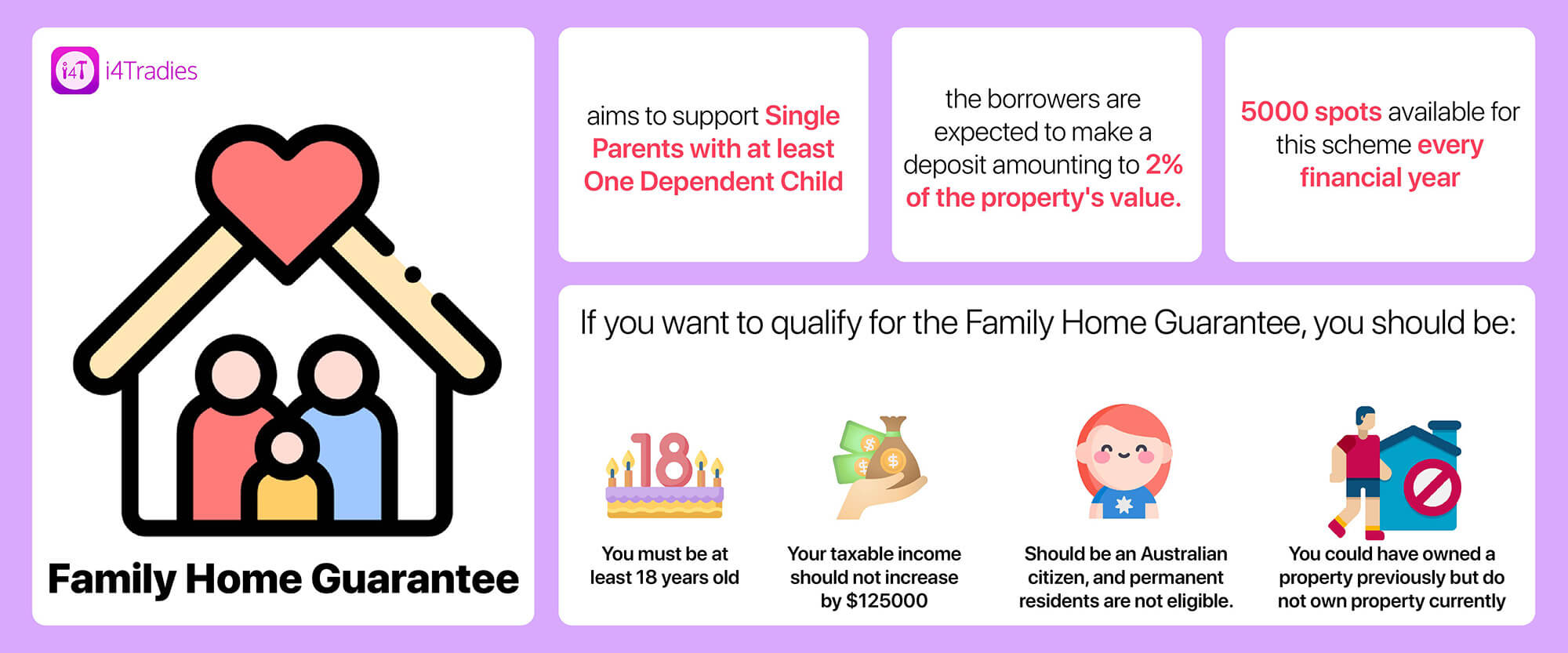

2. Family Home Guarantee

This is similar to the First Home Guarantee. However, this aims to support single parents with at least one dependent child. The NHFIC also carries out this program on behalf of the Australian government.

Under this scheme, the borrowers are expected to make a deposit amounting to 2% of the property’s value. However, the government has extended the courtesy by guaranteeing a maximum value of 18% of the property’s value. Therefore the borrowers don’t have to spend money on LMI.

There are currently 5000 spots available for this scheme every financial year. However, you should fulfill certain requirements to qualify for this scheme. There are both personal requirements and property requirements that you must fulfil. Some of the personal requirements are:

- You must be at least 18 years old.

- This is not limited only to first-home buyers. You could have owned a property previously but do not own property currently.

- Your taxable income should not increase by $125000.

- Should be an Australian citizen, and permanent residents are not eligible.

You can check your eligibility criteria from here more easily.

3. First Home Super Saver Scheme

In simple terms, the First Home Super Saver Scheme will allow people to save money for their first home through their super fund. This scheme allows you to use the voluntary contributions from your super fund to be kept as a deposit to buy your first home. However, you can only contribute $30,000 within two years. Hence your contributions are capped at $15,000 per year.

Under this scheme, only voluntary contributions can be used to buy the property. That means you cannot use:

- Government co-contribution.

- Compulsory contributions by the employer (Superannuation Guarantee).

- Child or spouse contributions.

- Contributions made by another organisation or an individual on your behalf (except where your employer makes additional contributions for you under an agreed salary sacrifice arrangement).

- Voluntary contributions to defined benefit funds or constitutionally protected funds.

There are also other criteria that you must fulfil to be eligible for this scheme. They are:

- You should be at least 18 years old (You can still make eligible contributions before turning 18).

- Should have never owned a property in Australia.

- Shouldn’t have released an amount from the super fund previously under this scheme.

State-specific government schemes and grants

There are government schemes and grants to which each state has adopted its own policies. These schemes are:

1. Stamp Duty

What is stamp duty? It’s a fee that you must pay when buying property in Australia. In some states, this is also known as transfer duty, and it should be paid upfront when buying the property.

This scheme will enable you to get concessions and reductions in stamp duty if you are buying a house for the first time.

The eligibility requirements and the concession amounts will vary from one state to another. If you are interested in finding them, follow the links below.

- Australian Capital Territory

- New South Wales

- Northern Territory

- Queensland

- South Australia

- Tasmania

- Victoria

- Western Australia

2. First Home Owner Grant

The federal government introduced First Home Owner Grant (FHOG) in 2000. From there, it has gone through various changes and amendments. Although the federal government has introduced this scheme, local governments of each state will fund and manage it.

So what is the First Home Owner Grant? This was originally introduced to offset the effect of GST on the property. Now, it is more of a one-off grant payment for the first-home buyers who qualify for all the eligibility criteria. This scheme will help first buyers to enter the housing market.

The eligibility criteria will be different in each state. Therefore the federal government has created a portal to grant access to the relevant FHOG sections in each state.

However, there are several common criteria. They are:

- You should be a first-time buyer. That means you or your spouse couldn’t have owned properties before.

- You should be an Australian Citizen (Permanent residents are allowed to apply in some states).

- You must live at least six months after building the house.

- You should be a real person and not a company or a trust.

- Most states have a minimum age requirement, which is 18 years.

Bottom-line

There are various government schemes and grants that will help you to build or purchase your own home in Australia. Therefore this milestone in your life will not be a dream forever.

However, there are certain criteria that you must fulfil to be eligible for any of the programs. These criteria may change according to the state you live in. Therefore visit the above links and stay updated about these schemes.

There are only limited spots for most of the programs. Therefore make sure to apply for them at your earliest convenience. Let’s build your dream house together.